Did you know that only 1/3 of Americans have a written financial plan?

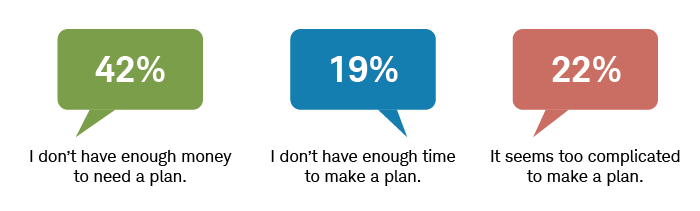

For those without, here are the 3 most common reasons for not having a written financial plan according to Schwab's 2021 Modern Wealth Survey:

In the rush of daily life, planning for anything more than a few days in advance can seem like a headache. It's natural to wonder: Does financial planning really help?

Absolutely! And here are just 5 of the reasons why!

1) A written financial plan increases confidence

Schwab’s survey found that 65% of people with a written financial plan say they feel financially stable, while only 40% of those without a plan feel the same level of comfort. Fifty-four percent of planners felt "very confident" they would reach their financial goals,

2) A financial plan can jumpstart savings, even with a small amount of money

The most common reason cited for not having a written financial plan is "I don't have enough money." This is a misconception. Planning, even in small steps, doesn't take large sums of money to start. In fact, financial planning can have a profound impact on lower-income households by helping people improve their saving and budgeting habits. A written plan helps savers prioritize their goals and, as mentioned earlier, provides a way to gauge success.

3) A financial plan helps your advisor with creating your customized investment portfolio

Your financial plan can give you the full lay of the land: You'll know what your goals are, how much time you have to reach them, and how comfortable you are with risk. Once you have a comprehensive view, you can figure out how to reach each individual goal.

That will involve both saving—setting aside money you'll need in the short term or for emergencies—as well as investing, which is setting aside money you'll need in the long term and that, ideally, can grow. And with your financial plan as a roadmap, you'll be better able to make thoughtful investing decisions—instead of heading out without a sense of direction and just hoping for the best.

4) A financial plan can lead to better habits

Financial planning is not just about investing; it's about what money can do for your confidence, security, and quality of life — such as the peace of mind offered by an emergency fund or the appropriate strategies needed to minimize taxes. Studies have also shown that good financial habits are also supported by planning.

Good Investing Habits. Healthy Money Habits

A sound Financial plan can help with both!

5) A financial Plan can be tailored to every personality type

Your approach to life can influence every decision you make, including those that involve your finances. By understanding the type of person you are with regard to planning, you can take proper steps toward reaching your financial goals.

Here are six types of financial planning personalities:

Organizer: Organizers love lists. Categorizing and arranging everything from their sock drawer to their personal finances gives them a warm, fuzzy feeling.

Architect: Architects are masters of both creativity and logic. They not only imagine the future but design solutions to make it happen.

Philosopher: Taken from the Greek word meaning "lover of wisdom," philosophers enjoy thinking about and solving problems.

Dreamer: Dreamers are the free spirits of our world who shake their head in confusion at all those who schedule their lives to the last detail.

Improviser: Improvisers are typically quite self-sufficient with a deep desire for independence and doing things their own way.

Maverick: Mavericks are unafraid and unapologetic individuals who would rather reshape their world than try to fit in it.

The Bottom Line...

A financial plan may sound like a chore. But it is the foundation upon which successful investors build, understand and achieve their objectives. Having a written financial plan can increase confidence and result in more constructive financial behavior. People working with a financial planner who is taking a holistic look at their needs, beyond just products and portfolio, are better off than those working with a planner who takes a pure transactional approach.

If now is the right time for you to FIRM up your family’s financial future, please fill out our contact form and we’ll be in touch!